How Can Businesses Integrate Embedded Finance Into Their Existing Platforms?

Contents

Understanding Embedded Finance

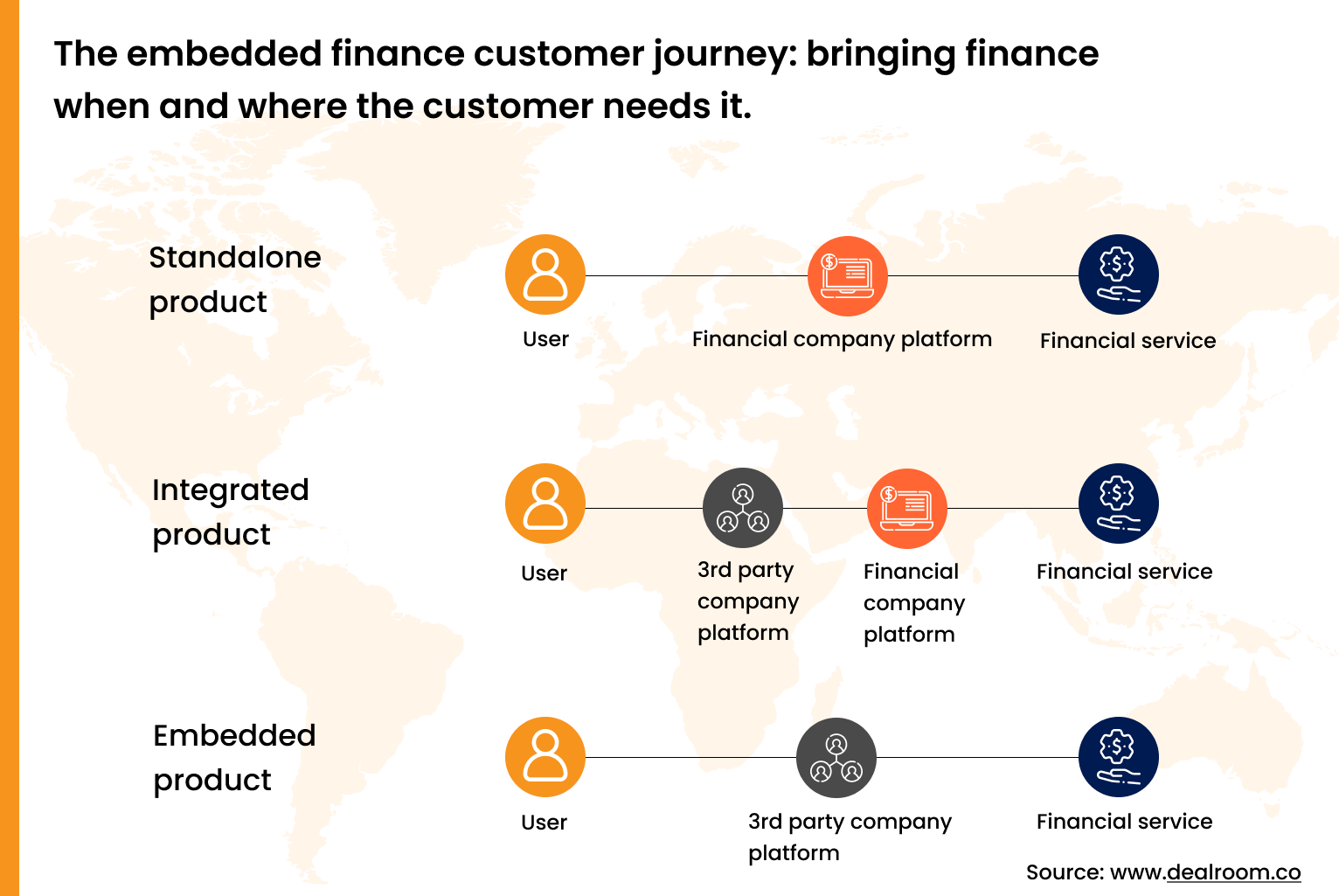

How can companies combine embedded finance into their current platforms? – Embedded finance is an idea the place non-financial corporations combine monetary companies instantly into their platforms to supply a seamless and complete consumer expertise. This permits companies to supply a variety of monetary merchandise equivalent to funds, lending, insurance coverage, and investments with out the necessity for patrons to depart their platform.

Embedded finance differs from conventional monetary companies in that it eliminates the necessity for third-party monetary establishments by instantly embedding monetary companies into the services or products of non-financial corporations. This not solely streamlines the client expertise but additionally opens up new income streams for companies.

Examples of Corporations Leveraging Embedded Finance, How can companies combine embedded finance into their current platforms?

- Uber: Uber gives quite a lot of cost choices instantly inside its app, permitting clients to pay for rides seamlessly with out the necessity to swap to a separate cost platform.

- Sq.: Sq. gives small companies with embedded monetary companies equivalent to point-of-sale programs, cost processing, and enterprise loans, all built-in into their platform.

- Shopify: Shopify has built-in monetary companies like Shopify Capital, which gives service provider money advances, instantly inside its e-commerce platform to assist companies handle their funds extra effectively.

Advantages of Integrating Embedded Finance: How Can Companies Combine Embedded Finance Into Their Present Platforms?

Integrating embedded finance into current enterprise platforms can deliver a variety of advantages for corporations trying to improve their operations and buyer expertise.

Enhanced Buyer Expertise and Income Progress

- Embedded finance permits companies to supply seamless and handy cost choices to their clients, bettering total satisfaction and loyalty.

- By integrating monetary companies instantly into their platforms, corporations can enhance income streams by way of charges, commissions, or partnerships with monetary establishments.

- Entry to embedded finance instruments can even allow companies to personalize their choices, resulting in increased buyer engagement and retention.

Streamlined Operations and Price Discount

- Embedded finance can automate numerous monetary processes equivalent to invoicing, billing, and payroll, decreasing handbook errors and saving time for workers.

- By centralizing monetary actions throughout the current platform, companies can remove the necessity for a number of software program options, resulting in value financial savings and operational effectivity.

- Integration of embedded finance can present real-time monetary knowledge and analytics, enabling corporations to make knowledgeable choices rapidly and successfully.

Methods for Integration

Integrating embedded finance into current platforms requires cautious planning and execution to make sure a clean transition and maximize the advantages of this revolutionary strategy.

Key Steps for Seamless Integration

- Assess Present Infrastructure: Consider your present platform to determine areas the place embedded finance could be built-in with out disrupting current operations.

- Collaborate with FinTech Companions: Work carefully with FinTech corporations to leverage their experience and expertise for a extra environment friendly integration course of.

- Implement Safe APIs: Combine safe APIs to facilitate communication between your platform and monetary service suppliers, making certain knowledge privateness and safety.

- Customise Consumer Expertise: Tailor the consumer expertise to include embedded finance seamlessly into your platform, enhancing usability and buyer satisfaction.

- Monitor Efficiency Metrics: Repeatedly monitor key efficiency indicators to trace the impression of embedded finance integration and make essential changes for optimization.

Potential Challenges and Options

- Regulatory Compliance: Keep knowledgeable about altering laws and guarantee compliance by way of common audits and updates to your embedded finance options.

- Knowledge Safety: Implement strong safety measures to guard delicate monetary knowledge and construct belief with clients who’re utilizing your platform for monetary transactions.

- Technical Integration: Deal with technical challenges by investing in expert IT assets and collaborating with skilled companions to streamline the combination course of.

Greatest Practices for a Easy Transition

- Present Coaching and Assist: Provide coaching classes and complete help to assist customers navigate the brand new embedded finance options seamlessly.

- Talk Adjustments Successfully: Hold stakeholders knowledgeable in regards to the integration course of, highlighting the advantages and addressing any considerations or questions promptly.

- Take a look at Completely: Conduct rigorous testing to determine and resolve any points earlier than launching the built-in embedded finance options to make sure a clean consumer expertise.

Expertise Necessities

In the case of integrating embedded finance into current platforms, companies want to make sure they’ve the suitable technological infrastructure in place. This contains the best software program options, instruments, and safety measures to guard monetary knowledge.

Technological Infrastructure

Companies trying to undertake embedded finance should have a strong technological infrastructure that may help seamless integration. This contains:

- API Integration: Using APIs to attach monetary companies with current platforms.

- Cloud Computing: Leveraging cloud-based options for scalability and suppleness.

- Knowledge Safety: Implementing encryption and entry controls to guard delicate monetary data.

Software program Options and Instruments

There are numerous software program options and instruments accessible for companies to undertake embedded finance, every providing distinctive options and functionalities. Some in style choices embrace:

- Fee Gateways: Facilitating on-line transactions securely and effectively.

- Monetary APIs: Permitting seamless integration of monetary companies into current platforms.

- Blockchain Expertise: Offering clear and safe transactions for digital belongings.

Safety Measures

Implementing embedded finance requires stringent safety measures to guard delicate monetary knowledge from cyber threats and unauthorized entry. Some key safety measures embrace:

- Finish-to-Finish Encryption: Securing knowledge transmission between programs to stop interception.

- Multi-Issue Authentication: Verifying consumer id by way of a number of authentication steps.

- Common Safety Audits: Conducting frequent assessments to determine and handle potential vulnerabilities.